There are some tax related court decisions that have significantly more widespread implications to the horse industry than others, one such decision, relating to land tax exemption, was handed down in the High Court yesterday.

Godolphin, on appeal, yesterday had their land tax exemption case unanimously dismissed by the High Court.

This decision is not good news for the industry, especially if the activities on your property contain a significant racing element. Racing is not considered a “primary production” activity.

As background, Godolphin secured special leave to appeal to the High Court against the decision of the NSW Court of Appeal denying their application for land tax exemption. The Court of Appeal had held that the land was not entitled to the exemption for land used for primary production within the Land Tax Management Act 1956 (NSW). That section exempted primary production land from land tax if the dominant use of the land was for the maintenance of animals for the purpose of selling them or their natural increase or bodily produce, i.e., breeding activities.

Since Revenue NSW denied their application for land tax exemption relating to the breeding and racing activities on their Woodlands and Kelvinside properties, Godolphin in the past few years have been working their way through the judicial system to get this decision overturned. The High Court was their last hope for justice.

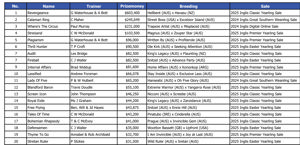

Godolphin has argued that it conducted an integrated stud operation (involving both breeding and racing thoroughbred horses) such that the dominant use of both properties was for the maintenance of animals for the purpose of selling their bodily produce or natural increase. The racing activities were undertaken with the objective of winning races and pursuit of stallion excellence were part of the overall objectives of increasing the value of Godolphin's stud operations (being nomination fees in particular and sale of the majority of Godolphin's progeny) and that the sales were sufficiently proximate - if that was a required element - to the maintenance of the animals on the properties.

The key issue for the High Court was whether the requirement of "dominant use" of land applied to both the "maintenance of animals" and also to the purpose of sale.

It was noted that neither party disputed the critical finding that a "significant use" of the two properties was animal maintenance for the purpose of selling animal produce and progeny.

In dismissing the appeal, the High Court held that though a significant use of the properties was for breeding horses, being the plurality held, this fell short of demonstrating that the "dominant use" of the land was for the purpose of selling them or their natural increase or bodily produce. In short, the amount of the land allocated for racing activities compromised their “dominant use” argument.

This is a nasty wake-up call for the industry as many operators may currently believe that their properties are subject to land tax exemption due to a significant amount of the property being used for breeding of offspring for the purpose of ultimate sale, notwithstanding that the balance of the property is used for racing only purposes.

Please do not hesitate to contact the writer if you wish for me to clarify or expand on any of the matters raised in this article.

PAUL CARRAZZO CA

CARRAZZO CONSULTING PTY LTD

801 Glenferrie Road, Hawthorn, VIC, 3122

TEL: (03) 9982 1000

FAX: (03) 9329 8355

MOB: 0417 549 347

E-mail: paul.carrazzo@carrazzo.com.au

Web: www.carrazzo.com.au