Over

the years of my consulting on property tax matters, it has always surprised me

as to how few rural property owners realise that property acquired before the Capital

Gains Tax (CGT) regime (ie pre-20 September 1985) is not always exempt from

CGT when sold.

When a breeding property is sold, or subject to offer, it's generally the time

our office is contacted by anxious vendors to sort out the tax implications of

the sale and, where possible, plan to reduce the tax on sale. The thing we

least like telling them is what they thought was a 100% tax free sale can, in

certain circumstances, be subject to CGT.

If you don't want a nasty tax surprise when you sell that "old family property in

the bush", I suggest you read this article as it spells out when a separate CGT asset is created on pre-CGT

farmland and what the CGT implications are when it's sold.

Can

pre-CGT property attract CGT on sale?

Many breeders have farmed the family property for years and there is a

perception that as it was acquired in the family many generations ago, CGT can

never apply to the sale of this property.

Yes..CGT assets acquired prior to 20 September 1985 are referred to as 'pre-CGT

assets' and thus generally not subject to the CGT regime.

However, certain assets are

specifically subject to CGT despite being "pre-CGT" assets. In particular,

breeders should note that capital gains and losses will not be exempt from CGT

where the following circumstances apply:

Farmland was acquired pre-CGT, and a building was constructed on (or

significant capital improvement were made to) the land on or after that date,

to the extent that the building/improvement constitutes a separate CGT asset .

Where the has been a change in the

underlying ownership of a pre-CGT company or trust that owns the property.

I won't discuss b) above as it's just too technical for our purposes, but seek

out your adviser if you think this could be an issue.

What

is a "separate CGT asset"?

Under common law, buildings, structures and capital improvements on

farmland form part of the farmland itself. As such, the farmland and any

attached buildings/structures/improvements are treated as a single CGT asset .

However, where farmland is acquired prior to 20 September 1985, the CGT rules

will apply to treat the sale of a portion of the pre-CGT farmland as being

subject to CGT in the following scenarios:

A building or structure constructed is a separate

CGT asset if:

A contract for the construction was entered into on or after 20 September 1985;

or

If no contract, construction commenced on or after 20 September 1985.

Where farmland acquired on or after 20 September 1985 (post-CGT farmland ) is to adjacent pre-GGT farmland , the

post-CGT farmland is taken to be a separate

CGT asset if it is amalgamated with the pre-CGT farmland into the one

title;

A capital improvement made to a CGT

asset (e.g. farmland) that was acquired pre-CGT is taken to be a separate CGT asset if the cost base of

the capital improvement (plus any related improvements) when the CGT sale

happens exceeds both :

The improvements threshold for the income year in which the CGT improvement

happened (e.g. the 'improvement threshold' for the 2018 income year is $147,582

and this threshold is calculated yearly by the ATO); and

5% of the capital proceeds of the CGT event.

What

happens when a "separate CGT asset" on pre-CGT farmland is

sold?

In any of the above scenarios, when the farmland is sold, the sale if

effectively treated as a disposal of two or more CGT assets, and the

following CGT consequences will arise:

any capital gain or loss arising in respect of the underlying pre-CGT farmland

will be exempt (i.e. the farmland the structure sits on remains a pre-CGT

asset); and

any capital gain or loss arising in respect of any separate CGT assets (i.e.

buildings, adjacent land and/or capital improvements acquired on or after 20

September 1985) will be subject to CGT.

Apportioning

proceeds on sale of a "separate CGT asset"

When dealing with separate CGT assets, the CGT rules require the capital

proceeds received upon the sale of farmland to be apportioned on a reasonable basis between the pre-CGT

underlying farmland and the post-CGT buildings/land/improvements. A 1998 tax

determination stated that an apportionment based on market values at the time

of sale is generally acceptable as "reasonable".

Example – Capital improvements made to pre-CGT land treated as a separate

CGT asset

Susan acquired farmland in the

1970s for $100,000. From that time, the farmland was used in a horse breeding

business carried on by a related company.

This farmland is pre-CGT farmland as it was acquired pre-20 September 1985 and,

ordinarily, would not be subject to CGT when sold.

The company's farming operations ceased during the 2015 income year, and

capital improvements to the farmland were made during the 2016 income year to

ready the farmland for sale. The improvements, costing a total of $260,000,

included clearing the land, engaging contractors to upgrade the electricity

connections and sewerage works, and rezoning the land for mixed property use.

Susan sold the farmland in the 2018 income year for $2 million dollars, and it

is considered to be the mere realisation of an asset (i.e. not a

"profit-making" venture).

Are the capital improvements "separate

CGT assets"?

Yes. These capital improvements will be separate CGT assets, as the

total cost base of the related capital improvements (i.e. $260,000) exceeds

both :

The improvements threshold for the income year in which the CGT

improvement happened (e.g. the 'improvement threshold' for the 2018 income year

is $147,582); and

5% of the capital proceeds of the CGT event (i.e. 5% of $2 million = $100,000).

The capital proceeds of $2 million need to be apportioned, on a

reasonable basis, between the pre-CGT farmland and the post-CGT capital

improvements to the land. For example, if the market value of the farmland at

the time of the CGT sale would have been $1.5 million had the improvements not been made, it would be reasonable

to attribute $500,000 (i.e. $2 million less $1.5 million) of the capital

proceeds to the post-CGT capital improvements.

Accordingly, the capital gain on that separate CGT asset is $500,000 less the

relevant CGT cost base items. As the improvements were held for at least 12

months, a 50% general CGT discount applies to this gain.

Note - if Susan is eligible, any capital gain may be reduced under the CGT small business concessions .

Please don't hesitate to contact the writer if you wish for me to clarify or

expand on any of the matters raised in this article.

DISCLAIMER

Any reader intending to apply the information in this article to practical

circumstances should independently verify their interpretation and the

information's applicability to their circumstances with an accountant or

adviser specialising in this area.

By Paul Carrazzo (CPA) from Carrazzo Consulting CPAs.

Pre-CGT farmland is not always tax exempt

Advertisment

More Reading...

Knight's Realm wins G3 Taranaki Cup

Elen Nicholas has ridden the highs and lows of racing with Knights Realm, and Saturday proved to be the pinnacle of their journey.

Book 1 Sets New Benchmark at NZB Centennial Sale

The first session at New Zealand Bloodstock’s 100th National Yearling Sale set a new benchmark, with the Book 1 Sale reaching total sales of over $79 million after two days of selling, a $3.6 million increase despite a more compact offering.

Sires With Winners - Monday January 26

Here is the full list of 41 stallions which had winners throughout Australasia today with winners and result details.

People at Karaka Day Two - We Found A Cool Horse

Day Two at Karaka and Maree McEwan was out speaking to some happy people, and along the way came across a very cool horse – he may have cost $950,000 but he seems priceless.

$1.1million colt for Sword of State

The dizzying rise of Cambridge Stud stallion Sword Of State continued at Karaka on Monday with a sale-topping $1.1 million yearling in his second crop.

Stakes Goals Ahead for Hello Youmzain 3YO

Trainers Darryn and Briar Weatherley were rapt with Bulgari’s runner-up effort behind Belle Cheval in the Gr.3 Almanzor Trophy (1200m) at Ellerslie last Saturday, and they are now eyeing further stakes targets at the Auckland track.

One to Watch – Warwick Farm

Golden Slipper winning sire Farnan has not been short of winners of late and produced his 20th Aussie winner of the season at Warwick Farm on Australia Day with the Waterhouse Bott stable producing a blue blood filly to win on debut.

Mulcaster Secures $950,000 Justify Colt

Bloodstock agent Guy Mulcaster secured the $850,000 highest-priced lot on Sunday’s opening day of Karaka 2026, and he followed it up on Monday with something even bigger.

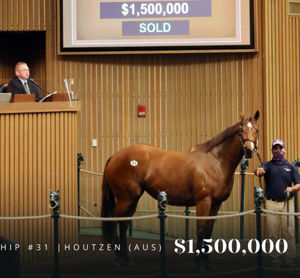

US Stakes-Winner for Aussie Sprint Star Houtzen

A brilliant winner of the MM 2YO Classic in 2017, I Am Invincible filly Houtzen is beginning to make her mark at stud with her talented three year-old colt Greenwich Village landing his first stakes race at Santa Anita on Sunday.

Personal Best for Anders at Karaka Book 1

A brilliant run by Farnan colt Magill to finish a close second to Dream Roca in the Karaka Million on Saturday put the spotlight on his yearling three-quarter brother by Anders, who sold for $380,000 at Karaka Book One on Monday.